Affordable Insurance for Seniors with Medical Conditions

As we age, our insurance needs evolve, particularly when it comes to car insurance. For seniors with medical conditions, finding affordable coverage can be challenging. This article explores how older drivers can secure budget-friendly car insurance policies that accommodate their health concerns while maintaining comprehensive protection on the road.

How does age affect car insurance rates for seniors?

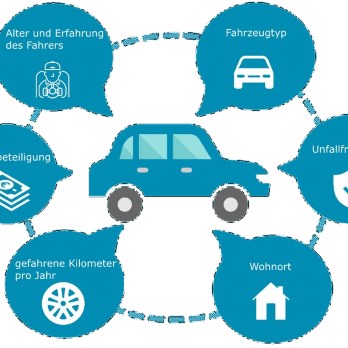

Age is a significant factor in determining car insurance premiums. While senior drivers often benefit from years of experience, insurance companies may view them as higher risk due to potential age-related health issues. However, many insurers offer specialised policies for older drivers, recognising their unique needs and driving habits. These tailored senior car insurance policies for 2025 and beyond aim to provide comprehensive coverage at reasonable rates.

What medical conditions can impact senior drivers’ insurance?

Various medical conditions can affect a senior’s ability to drive safely, which in turn influences their insurance rates. Common conditions include:

-

Vision problems (e.g., cataracts, glaucoma)

-

Hearing impairments

-

Arthritis and reduced mobility

-

Cognitive issues (e.g., early-stage dementia)

-

Cardiovascular conditions

Insurance providers may require a medical assessment or documentation from a healthcare professional to determine the impact of these conditions on driving ability and adjust premiums accordingly.

Are there specific discounts available for senior drivers in the UK?

Yes, many insurance companies offer safe driver discounts for seniors in the UK. These discounts reward older drivers for their experience and good driving record. Some common discounts include:

-

No-claims bonus: A significant discount for drivers who haven’t made a claim in several years.

-

Low mileage discount: For seniors who drive less frequently.

-

Advanced driving course completion: Demonstrates continued commitment to safe driving.

-

Vehicle safety features: Discounts for cars equipped with modern safety technology.

By taking advantage of these discounts, seniors can significantly reduce their insurance premiums while maintaining comprehensive coverage.

How can seniors find budget-friendly insurance options for 2025?

As we look ahead to 2025, seniors can explore several strategies to secure affordable car insurance:

-

Compare quotes from multiple providers specialising in senior driver policies.

-

Consider usage-based insurance programs that track driving habits and reward safe behaviour.

-

Explore telematics options that offer personalised premiums based on actual driving data.

-

Review coverage needs annually and adjust as necessary to avoid over-insuring.

-

Consider increasing deductibles to lower monthly premiums if financially feasible.

What unique considerations exist for UK senior drivers?

In the UK, senior drivers face specific challenges and opportunities when it comes to car insurance. The Continuous Insurance Enforcement law requires all vehicles to be insured unless declared off-road with a Statutory Off-Road Notification (SORN). This means seniors must maintain insurance even if they drive infrequently. However, the UK’s strong consumer protection laws also ensure that insurers cannot discriminate solely based on age.

Additionally, the UK’s comprehensive healthcare system can be advantageous for seniors with medical conditions. Regular health check-ups and proactive management of conditions can help demonstrate to insurers that a senior driver remains capable and safe on the road, potentially leading to more favourable insurance terms.

How do senior driver policies with no-claims bonuses work?

Senior driver policies with no-claims bonuses are an excellent way for older drivers to reduce their insurance costs. Here’s how they typically work:

-

Accumulation: Drivers build up their no-claims bonus over years of claim-free driving.

-

Discount levels: The longer the claim-free period, the higher the discount, often up to 70-80% off the base premium.

-

Protection options: Many insurers offer the ability to protect the no-claims bonus, allowing a certain number of claims without losing the discount.

-

Transferability: Some insurers allow seniors to transfer their no-claims bonus to a new policy or provider.

-

Proof requirements: Seniors may need to provide proof of their no-claims history when switching insurers.

| Provider | Policy Type | Key Features | Estimated Annual Premium |

|---|---|---|---|

| SAGA | Comprehensive | Unlimited cover driving other cars, Courtesy car | £350 - £450 |

| Age Co | Comprehensive | 24/7 claims helpline, Windscreen cover | £300 - £400 |

| LV= | Comprehensive + | Uninsured driver promise, Misfuelling cover | £400 - £500 |

| Rias | Comprehensive | Legal expenses cover, Personal accident cover | £320 - £420 |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

In conclusion, while seniors with medical conditions may face challenges in finding affordable car insurance, there are numerous options available. By leveraging tailored policies, taking advantage of discounts, and maintaining a good driving record, older drivers can secure comprehensive coverage at reasonable rates. As the insurance landscape continues to evolve, staying informed about new products and comparing options regularly will help seniors find the best policies to suit their needs and budget.